News & Views from Around the Web

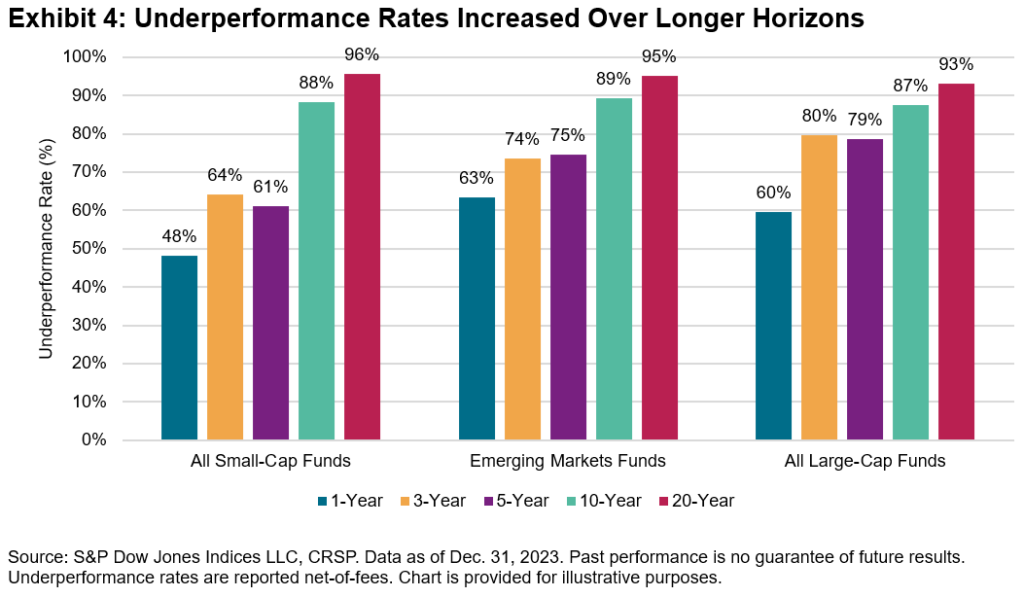

Do Active Funds Outperform in Less Efficient Markets?

“All told, the rare success of active funds confirms that while there may be greater potential for outperformance in some markets, greater opportunity for outperformance is no guarantee of actual outperformance.”

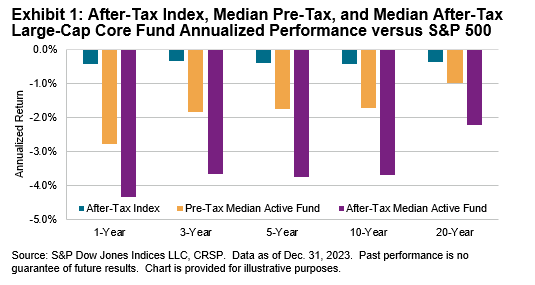

After Taxes, the Case for Index Funds is even Stronger.

After tax, the median active fund trailed the S&P 500® over every time horizon, by up to 4.3% annually (see Exhibit 1).

Investing Made Simple

I’m a huge fan of Mike Piper, CPA. He gets it!

“Interestingly, most investors actually would be better off in index funds. Why? Because — due to the high costs of active management — the majority of actively managed funds fail to outperform their respective indexes.”

Here’s a great summary of his book “Investing Made Simple: Investing in Index Funds Explained in 100 Pages or Less“.

What Does Retirement Mean?

“Retirement has changed. It’s no longer about getting your gold watch and playing golf all the time. Retirement is now a frame of mind – you’re retired when you can do what you want. It doesn’t necessarily have anything to with whether you are drawing a paycheck or not.” Read the full article here…

Career Risk Traps Advisors Into Taking On Excess Risk

“There is a big difference between a financial advisor or portfolio manager and an individual investor. The difference is the “career risk” of underperformance from one year to the next. Therefore, advisors and managers MUST own the assets that are rising in the market or risk losing assets.” Read the full article here…

There is no Persistence in Mutual Fund Performance

“Exhibit 1 illustrates that the percentage of top-half actively managed domestic equity funds consistently remaining in the top half over a five-year period (see Report 2) was less than a random distribution would suggest, evidence that active outperformance, when it occurs, tends to be the result of luck rather than genuine skill.” Read the full article here…

Warren Buffet’s $1 million Bet

“In 2007, legendary investor Warren Buffett made a $1 million bet against Protégé Partners that hedge funds wouldn’t outperform an S&P index fund, and he won.” Read the full article here…

Underperformance Rates are “Abysmal” for Active Managers

“After five years, the percentage of large caps underperforming benchmarks is 84%, and this grows to 90% and 95% after 10 and 20 years respectively.” Read the full article here…

Can Stock Pickers Fight the Rise of Passive Investors?

“‘Don’t look for the needle in the haystack. Just buy the haystack.’ Though many still tout their stock and bond picking credentials, active fund managers only rarely generate alpha (or market-beating returns). In the long term the index tends to win, substantiating Bogle’s advice.” Read the full article here…

How Much Room is There for Active Management?

“Something happened late last year that had long been predicted in the asset management world, but nonetheless was a major event: money in index funds overtook the assets in active ones <because> the majority of actively managed funds are underperforming passively managed index funds.” Read the full article here…